Our award-winning aviation team combines in-depth industry knowledge and decades of experience with a wide breadth of relationships across the entire sector encompassing every phase of our clients' and their assets' lifecycle.

Leveraging the size and strength of the MUFG network, we provide and create a suite of financial products and services for the acquisition, ownership of, and investment in aircraft, including but not limited to:

- Commercial debt (secured & unsecured)

- Export credit

- Financing of sale and lease back of aircraft

- Portfolio/warehouse financing

- Engine financing

- Finance lease and operating lease financing (including JOL & JOLCO)

- Structured capital markets

- Asset-backed securitisation

- Pre-delivery and "end-of-life" asset finance solutions

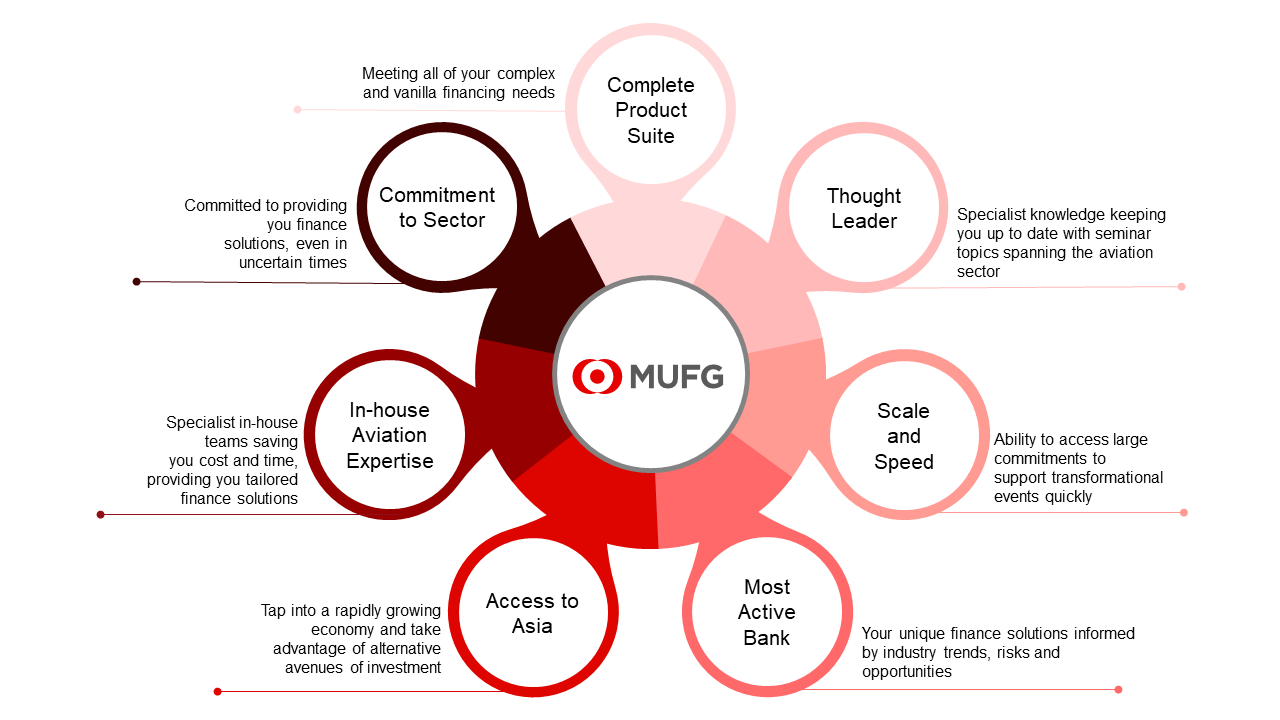

MUFG has been involved in aviation for more than 30 years and in 2019 the bank expanded its global aviation offering, strengthening our team with the addition of highly experienced asset-based finance and aviation specialists. The size of MUFG's balance sheet and international presence, as well as our extensive expertise in capital markets, act as key differentiators in our ability to provide financial services to the aviation industry. Our team prides itself on tailoring solutions and supporting a range of clients on their journey from the inception of a transaction through to maturity.

Our global aviation team is based in London, Amsterdam, Frankfurt, New York, Singapore, Tokyo and Hong Kong and work seamlessly together to provide cross-border services for structured capital market products and corporate banking capabilities.

Our international network gives us a global platform from which to work and meet the needs of our clients, whatever their size and wherever they are based. We can serve airframe and engine manufacturers and traders, MRO's, airlines, operating lessors, and investors, supported by our three in-house specialist support teams – aviation advisory, asset management and research – all based in London.

Aviation advisory: We assist airlines, lessors and investors on a number of fronts, including, but not limited to: equity raising for platforms, ESG advisory, analysis around Lease versus Buy, and assisting on debt ratings.

Aviation asset management: We work across regions assisting in the creation and management of financial solutions and products, from origination stage through to maturity, supported by our extensive technical and commercial knowledge of maintenance organisations, airlines, lessors and manufacturers.

Aviation research: We use our in-depth knowledge, insight and analysis of the market for aircrafts and engines, to support the bank's origination team, enabling MUFG to be creative with its client-focused structured finance solutions.

Please follow the links to find out more about upcoming conferences, awards and articles/insights.