Over the past decade, we have seen a convergence of the physical supply chain with the financial supply chain among our clients, including multinational corporations and small- to medium-sized companies. With our long-standing industry experience and deep understanding of the global supply chain, MUFG is ideally positioned to help both buyers and suppliers succeed in a complex business environment.

Helping clients to navigate the challenges of optimising working capital is at the heart of our business. Our Specialists in our Working Capital Solutions team work in conjunction with colleagues and in close collaboration with clients to design and develop a comprehensive suite of services and solutions that best meet the needs of each client.

Today, both buyers and suppliers are looking for ways to improve their working capital. Some may look to reduce financial or payment costs while others may look to generate free cash flow or incremental liquidity by speeding up their cash conversion. Solutions to accomplish these objectives include Supply Chain Finance and Dynamic Discounting.

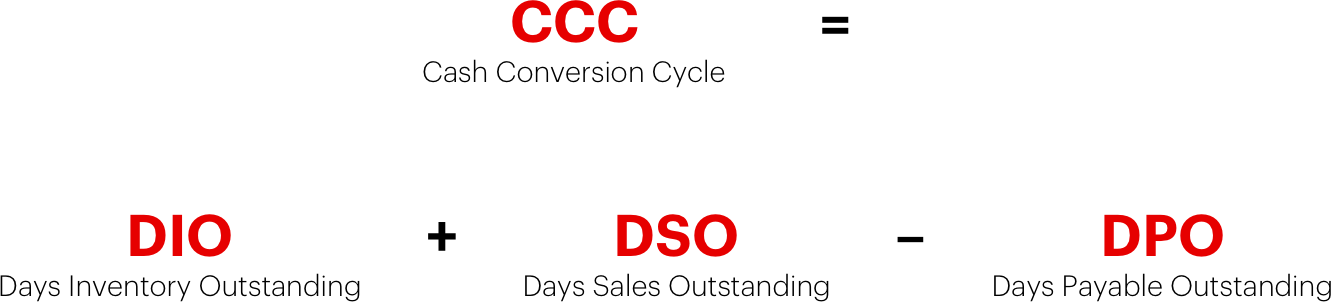

Increasing or decreasing one of the levers in the cash conversion cycle equation can improve working capital. Some clients may look to minimise DIO or DSO by discounting their receivables or increase DPO by holding onto their cash longer and extending payment terms.

What is Supply Chain Finance?

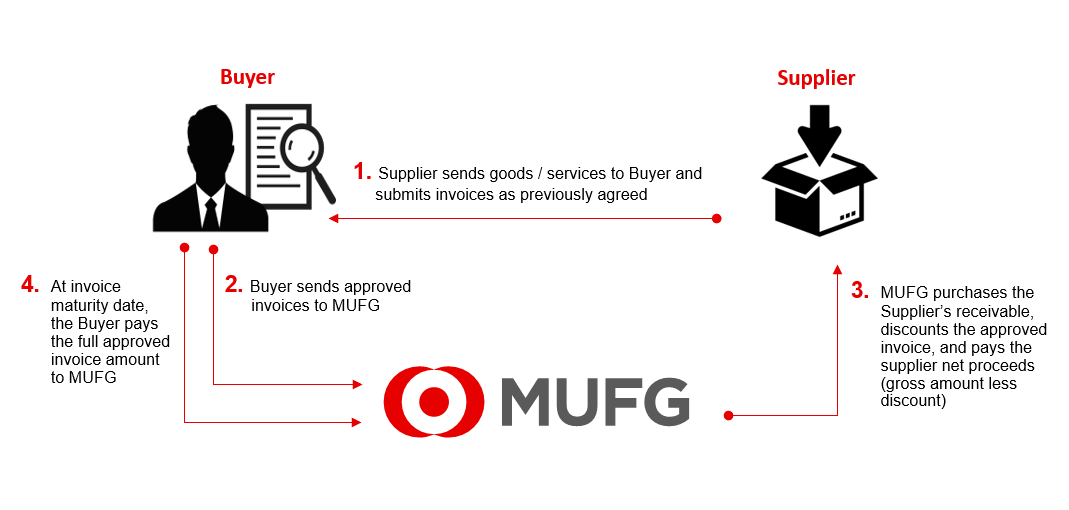

Supply Chain Finance (SCF) helps buyers to strengthen relationships with their suppliers by providing them with access to economically priced short-term funding. MUFG's proprietary technology platform provides both buyers and their suppliers with insight into payments and payment history.

How does Supply Chain Finance work?

Benefits for Buyers

Supply Chain Finance programmes help buyers to:

- Drive sustainability of supply chain

- Strengthen relationships with suppliers

- Streamline the payment process

Benefits for Suppliers

Supply Chain Finance programmes help suppliers to:

- Turn Accounts Receivables into cash faster at an attractive rate

- Improve working capital metrics to support their growth

- Access remittance information via a dedicated supplier portal