MUFG EMEA is calling for smarter, demand-linked funding solutions to accelerate growth in the low-carbon hydrogen sector. Low-carbon hydrogen is a central component of net zero infrastructure and operationalising it will be vital to many countries' path to Net Zero. The recommendations, set out in a new whitepaper, are part of its Low Carbon Financing Series, an initiative examining what it takes to commercialise climate-critical infrastructure.

The whitepaper highlights how even in well-supported markets, such as the UK, EU and Japan, tangible progress has been slower than expected as developers have grappled with the financial reality of large and complex ventures. Bloomberg New Energy Finance (BNEF) estimates that just 30% of capacity announced for commissioning by the end of the decade is likely to come online [1].

Global demand for hydrogen has continued to rise, with the International Energy Agency tracking over 2,200 projects across planning, construction and commissioning phases (as of November 2024), which represents a 40% increase over 12 months. However, of these, only 434 have reached final investment decision (FID) by September 2024, a sign that project delivery is stalling despite growing policy support from more than 74 countries seeking to gain a foothold in the low-carbon energy sector [2]. Clean hydrogen consumption projected to reach between 125-585 million tonnes per year by 2050 [3], driven by expected uptake in industries such as steel, chemicals and fertilisers.

Similarly, developers are committing more capital towards hydrogen projects; the total investments across projects phases have increased from USD 90 billion in 2020 to USD 390 billion in 2022 and USD 680 billion in 2024 [4] . This growth demonstrates the continued commitment from the private sector to develop hydrogen projects, despite current industry headwinds such as increased inflation and interest rates, turbulence in global energy markets following the Ukraine crisis, constrained supply chains, and higher than anticipated renewables prices.

Despite growing policy backing and greater investment appetite developers face persistent barriers. MUFG identifies two primary limiting factors: the cost gap to grey hydrogen that has not sufficiently lowered, and insufficient appetite for low-carbon hydrogen among buyers.

To bridge the cost gap, governments in the UK, the EU, and Asia have issued support mechanisms targeting hydrogen production with initiatives to bolster supply. These initiatives coincide with a 90% uptick in projects worldwide reaching final investment decisions [5] . Meanwhile, BNEF estimates that, by 2030, five countries will have achieved the task of making green hydrogen cheaper than grey, with others following their progress (see Figure 1).

Case studies and market gaps

The paper analyses three leading markets, UK (p. 6), EU (p. 7) and Japan (p. 9), and finds that even advanced policy frameworks are struggling to deliver at scale.

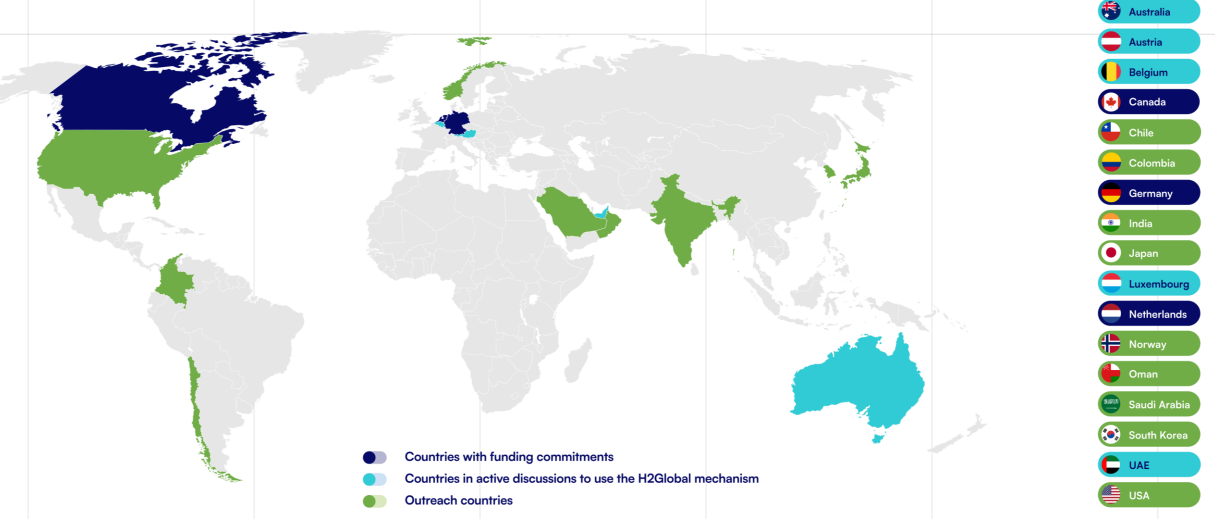

Figure 1: Global engagement across H2Global auction and mechanism - sourced: h2-global.org

Recommended Solutions:

To address the disconnect between funding availability and project viability, MUFG proposes several targeted mechanisms to strengthen the financial case for hydrogen:

- Tax credits for low-carbon hydrogen sold to strategic sectors such as steel production, fertilizer and sustainable aviation fuel (E-SAF), to improve cost competitiveness and stimulate demand

- Industry specific Contracts for Difference (CfDs) that offer higher strike prices for buyers in hard-to-abate sectors, helping to ensure more predictable and investable revenue streams

- Schemes such as H2Global – a market-enabling intermediary, that bridges the gap between hydrogen producers and offtakers that de-risk investments and can stimulate market development and price discovery.

Andrew Doyle, Executive Director, Power & Renewables, Project Finance, MUFG EMEA said:

"The low-carbon hydrogen sector is at a critical juncture. While we've seen significant policy momentum globally, our analysis shows that current funding approaches aren't translating into the project delivery needed to meet net-zero targets. Governments and industry must look at current best practice and innovative mechanisms to increase the number of projects that reach final investment decision.

The industry requires a shift towards demand-linked financing mechanisms that provide certainty for both producers and off-takers. Without addressing the cost competitiveness gap and securing firm buyer commitments from project inception, we risk stalling progress in a sector essential for decarbonising hard-to-abate industries."

The white paper concludes that while market momentum may appear to be slowing, this represents a natural phase in the maturation of a nascent industry. With well-designed and timely policy support, the hydrogen sector remains well-positioned to scale up and play a central role in meeting ambitious green hydrogen deployment targets, supporting broader decarbonisation and energy security goals.

Click here to download the full report.

[1] Hydrogen Supply Outlook 2024

[3] Global Energy Perspective 2023: Hydrogen outlook