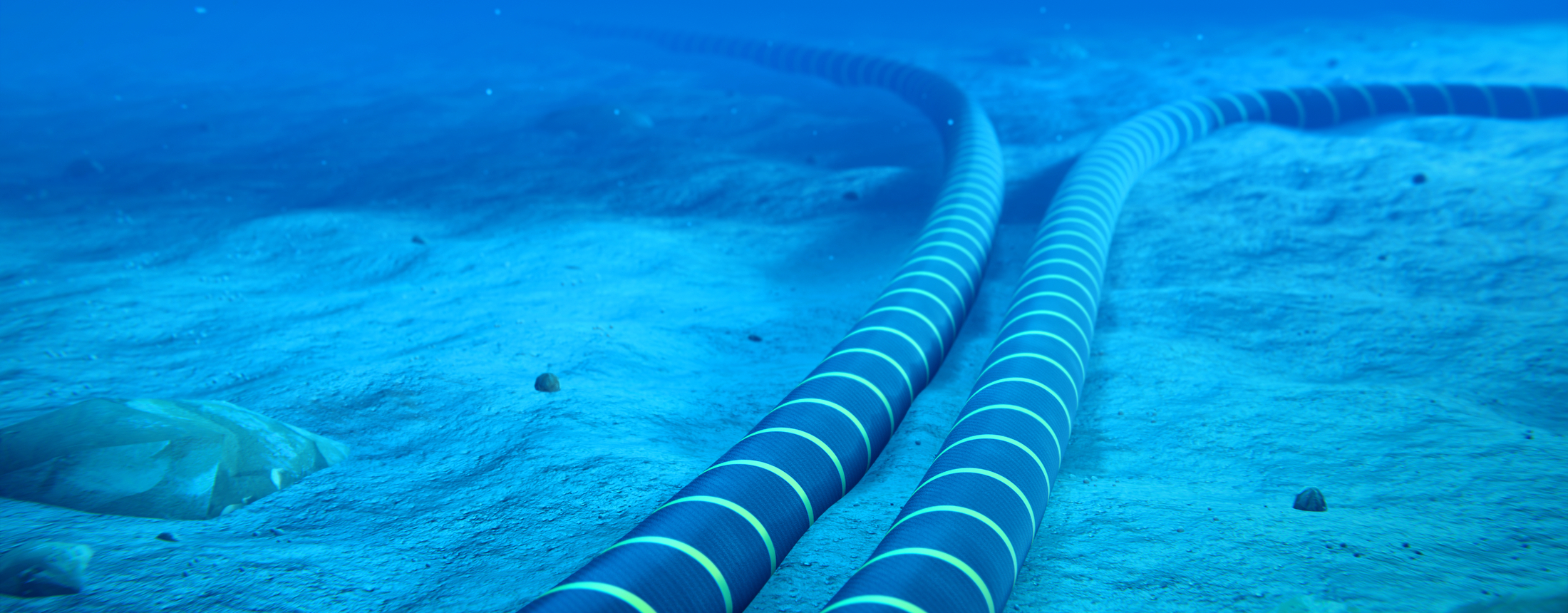

While interconnection is not a new technology; the first UK-France HVDC interconnector became operational in 1961 , it is only in recent years that the sector has seen renewed interest, innovation and investment. The trend has primarily been driven by cross-country trading, a requirement and desire to geographically diversify power generation due to the increased penetration of intermittent renewables, and the emergence of ever larger offshore windfarms requiring significant submarine connections. Such large windfarms also reinforce the need to have interconnection between markets, given the amount of bulk power they deliver.

In Europe in particular, interconnectors are seen as fundamental for Europe's energy market to operate as efficiently as possible, allowing countries to share surpluses of renewable electricity and provide balancing services.

Still, a combination of adverse investment conditions and regulatory ambiguity with a general lack of incentives has led to interconnection levels lagging behind targets.

Separately, driven by the developments in the offshore wind space and enabled through regulatory changes, offshore wind transmission infrastructure has become an asset class in itself.

Considering the co-location of interconnectors and large offshore wind farms in the North and Baltic Seas, as well as the cost impact of exporting electricity over longer distances, there is logic in exploring future hybrid, offshore grid solutions which drive efficiencies, simplify connections and enable economies of scale.

As investment in renewable technologies further accelerates and regulators and industry come together to find investment-enabling business models, we expect to see an increased focus on and accelerated rollout of new interconnectors.

In this paper, we explore some of bankable business models for these technologies and provide commentary from a commercial bank perspective.

Download the report: Electricity Interconnectors and offshore transmission in the EMEA region